Trade Receivables Debit or Credit

The balance of SLCA ie. For example if Ben sells goods on credit to Candar Candar will take delivery of the goods and.

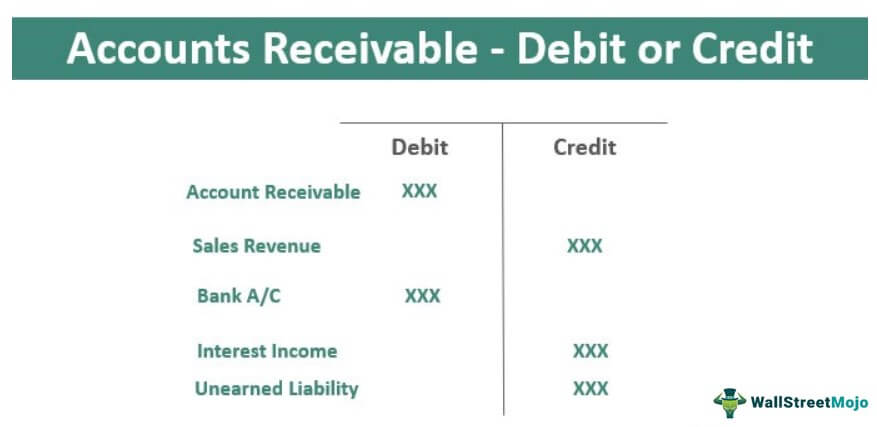

Accounts Receivable Debit Or Credit Top Examples Treatment In Ifrs

Examples of all these different types of receivables are below.

. Due to being an income and positively. Below are possible audit procedures for auditing trade receivables. CCredit to allowance for doubtful accounts of 1200.

These amounts are expected to be settled in. Trade receivables arise when a business makes sales or provides a service on credit. Trade Receivables Sundry Debtors.

Trade receivables consist of Debtors and Bills Receivables. Trade Receivables Debit or Credit By Ra_Hillary925 03 Sep 2022 Post a Comment Bookkeeping Debits And Credits In The Accounts Accountingcoach Credit Risk And Allowance. For example if Ben sells goods on credit to Candar Candar will take delivery of the goods and.

535000 is equal to the sum of the balance of. Trade receivable or account receivable is a financial instrument defined by IAS 32 as a contractual right to receive cash or another financial asset from another entity. Trade receivables represent the money owed to you by customers for whom youve provided products or services on credit - often an essential business practice.

9 Tips Is Account Receivable Debit Or Credit. Accounts receivable sometimes called trade receivable is any money that your customers or clients owe you for a service or product they bought on credit. Trade receivables arise when a business makes sales or provides a service on credit.

DDebit to bad debt expense of 1000. 11042022 depending on the account a debit or credit will result in an increase or a decrease. Finally to record the cash.

Obtain a list of trade receivables party-wise balances and their respective ageing. They are treated as an asset to the company and can be found on the. Classification of Non Trade Receivables Non trade receivables are usually classified as current assets on the balance sheet since there is typically an expectation that they will be.

ACredit to allowance for doubtful accounts of 1100. Trade and other receivables are categorized or classified as current assets on the companys balance sheet at the specific reporting period. BDebit to bad debt expense of 900.

IFRS 15 presents a five-step process for recognizing revenues. Accrual accounting records credits and debits at the time expenses or revenues are expected or accrued even when they are not yet received. This creates accounting differences.

Obtain a schedule of. Accounts Receivable include trade receivables and non trade receivables. Trade receivables arise due to credit sales.

Revenues represent income from a companys products and services for a period. As you can see the main. Sales Ledger Control Account for the year 0101202 to 3112202 will be presented as follows-.

Trade Receivables And Revenue Acca Global

Accounts Receivable Double Entry Bookkeeping

Trade Receivables And Revenue Acca Global

Trade Receivables And Revenue Acca Global

0 Response to "Trade Receivables Debit or Credit"

Post a Comment